Under the headline "Apple Reports Record Results," the company delivered what appears at first look a modest performance in its December quarter. For the 13-week period ended December 29, 2012, Apple reported revenue of $54.512 billion and earnings per share of $13.81. The outcome represents revenue growth of 17.65% over the prior-year period and a slight decline in earnings per share from $13.87.

The December quarter, Apple's first quarter of FY2013, was 13 weeks in length versus 14 weeks in the prior-year period. Apple's fiscal quarters are usually 13 weeks in length and always end on a Saturday. Every 5 or 6 years, depending on the number of leap days in the multi-year period, Apple adds a 14th week to its first fiscal quarter to align fiscal quarters closer to calendar quarters. On a weekly basis, Apple's revenue was $4.2 billion in the recent December quarter versus $3.3 billion in the prior-year period. On an equal week basis, revenue in the quarter rose 26.7%

However, the market's response to the December quarter results drove the share price down more than 12% to just over $450 on extraordinarily high volume the day after the release of earnings. Apple's overall revenue growth rate and the rate of growth in iPhone and iPad unit sales did not impress the Street.

iPhone and iPad Unit Sales

In the December quarter, iPhone unit sales rose about 29% to 47.789 million units and iPad unit sales rose about 48% to 22.86 million units. iPhone revenue growth tracked close to the rate of growth in unit sales, but iPad revenue rose only 22% year-over-year due to the influence of the lower-cost iPad mini.

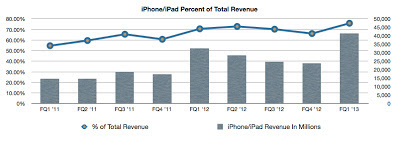

The graph below illustrates the rising percentage of Apple's revenue provided by the iPhone and iPad lines.

Mac and iPad Unit Sales

In the December quarter, Mac unit sales fell about 22% due in large part to constrained supplies of the new iMacs. Apple ended the December quarter with Mac channel supply below the desired target range. As expected, iPod unit sales continued to decline. Apple sold about 12.679 million iPods, off 18% on a year-over-year basis.

Apple's high concentration of revenue in its newest product lines, the 14-week prior-year period and lowered gross margin due to multiple product transitions in the quarter, created an outcome that underwhelmed investors. Gross margin dropped from last year's unsustainable 44.68% to about 38.63% in the December quarter. But there's more to the story.