Under the headline "Apple Reports Record Results," the company delivered what appears at first look a modest performance in its December quarter. For the 13-week period ended December 29, 2012, Apple reported revenue of $54.512 billion and earnings per share of $13.81. The outcome represents revenue growth of 17.65% over the prior-year period and a slight decline in earnings per share from $13.87.

The December quarter, Apple's first quarter of FY2013, was 13 weeks in length versus 14 weeks in the prior-year period. Apple's fiscal quarters are usually 13 weeks in length and always end on a Saturday. Every 5 or 6 years, depending on the number of leap days in the multi-year period, Apple adds a 14th week to its first fiscal quarter to align fiscal quarters closer to calendar quarters. On a weekly basis, Apple's revenue was $4.2 billion in the recent December quarter versus $3.3 billion in the prior-year period. On an equal week basis, revenue in the quarter rose 26.7%

However, the market's response to the December quarter results drove the share price down more than 12% to just over $450 on extraordinarily high volume the day after the release of earnings. Apple's overall revenue growth rate and the rate of growth in iPhone and iPad unit sales did not impress the Street.

iPhone and iPad Unit Sales

In the December quarter, iPhone unit sales rose about 29% to 47.789 million units and iPad unit sales rose about 48% to 22.86 million units. iPhone revenue growth tracked close to the rate of growth in unit sales, but iPad revenue rose only 22% year-over-year due to the influence of the lower-cost iPad mini.

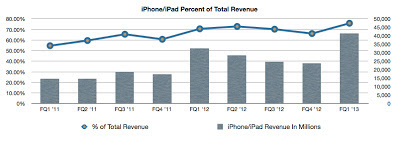

The graph below illustrates the rising percentage of Apple's revenue provided by the iPhone and iPad lines.

Mac and iPad Unit Sales

In the December quarter, Mac unit sales fell about 22% due in large part to constrained supplies of the new iMacs. Apple ended the December quarter with Mac channel supply below the desired target range. As expected, iPod unit sales continued to decline. Apple sold about 12.679 million iPods, off 18% on a year-over-year basis.

Apple's high concentration of revenue in its newest product lines, the 14-week prior-year period and lowered gross margin due to multiple product transitions in the quarter, created an outcome that underwhelmed investors. Gross margin dropped from last year's unsustainable 44.68% to about 38.63% in the December quarter. But there's more to the story.

The Mysterious Case of Apple's Missing Growth

The graph below illustrates that despite the drop in year-over-year gross margin and lowered rates of revenue growth, net income as a percentage of revenue remained strong.

Apple's net income performance per revenue dollar was supported by a significant drop in the percentage of revenue consumed by operating expenses. In the December quarter, operating expenses fell to about 7.1% of recognized revenue.

Gross Margin

In the December quarter, gross margin dropped from 44.68% in the prior-year period to 38.63%. Gross margin has returned to the rates Apple realized in FY2011. The high costs of the iPhone and iPad product transitions, including the introduction in the quarter of the iPad mini, drove gross margin below the prior year's unsustainable rate. Gross margin will improve in subsequent quarters as the iPhone 5 handset series enters its second year of production and the iPad mini, which remained in constrained supply through the end of the December quarter, becomes available in greater numbers.

Balance Sheet Versus Income Statement

Most observers look to the income statement to determine the company's growth. However, Apple's balance sheet that accompanied the December quarter revenue and earnings numbers tells a much different story. It's not so much that Apple's rates of growth have declined, it's an issue of discovering where the current rates of growth are reported.

Apple's Cash Position

Apple ended the quarter with cash and marketable securities of over $137 billion versus about $121 billion at the end of the September quarter. This is despite $2.493 billion in dividend distributions to shareholders during the period and share repurchases totaling $1.950 billion. During the quarter Apple generated cash flow from operations of over $23 billion. Depreciation, a non-cash expense, increased more than 100% year-over-year to $1.588 billion. Shareholders' equity, net of dividends and share repurchases, rose sequentially to $127.346 billion from $118.210 billion at the end of the September quarter.

Apple's Deferred Revenue Balances

Apple defers a portion of revenue from each Mac and iOS device sold due to the rights of device owners to receive no-cost operating system upgrades over the estimated economic life of the unit. In the December quarter, Apple deferred $1.611 billion in revenue from device sales, unredeemed iTunes gift card balances and AppleCare extended warranty services. At the end of the December quarter, Apple's deferred revenue balance totaled $7.274 billion. Most of this deferred revenue balance will be recognized as net sales over the next eight fiscal quarters. The deferred revenue in the quarter contributed to the company's cash flow from operations but did not appear in the quarter's net sales line.

Apple's Deferred Tax Liabilities

There's much confusion over Apple's reported tax rate. What's not considered by most observers is that Apple declares each quarter a US tax expense on much of the company's foreign earnings although the cash generated by those earnings remains outside the United States and is not subject to tax payments until the foreign earnings are brought into the United States.

According to the company's Form 10-K for the fiscal year ended in September, Apple's deferred tax liabilities from earnings of foreign subsidiaries totaled $14.712 billion. In the December quarter, Apple deferred $1.179 billion in income tax expense.

Much of Apple's cash and marketable securities are held outside the United States. Should a sizable portion of these dollars be repatriated, it would not trigger additional tax expense. It would trigger the payment of taxes already recognized as tax expense in past quarterly periods. The tax expense has already been declared on much of the company's foreign earnings although the tax payments have not been made because the cash remains outside the United States.

Apple's March Quarter Guidance

Beginning with the March quarter, Apple is no longer providing earnings guidance for future periods. Apple will now provide a revenue guidance range and guidance on anticipated gross margin and tax rates.

For the March quarter, management is providing an anticipated revenue range of $41 billion to $43 billion. $41 billion in revenue in the March quarter would represent growth of about 4.63% and $43 billion in revenue would represent growth of about 9.73%.

At the end of the December quarter, Apple was struggling to meet demand for the company's new iMacs, the iPad mini was in constrained supply and demand for the iPhone 4 series handsets was greater than management apparently anticipated. The issue for the March quarter is execution and bringing product supplies into equilibrium with evidenced demand. Guidance remains conservative even with the change of approach.

Defending The Share Price

The pressure on the share price remains intense and management, when questioned during the quarterly conference call with analysts, did not provide insights into any plans for an expanded share repurchase program to defend the share price. As of the end of the December quarter, Apple has used just under $2 billion of the $10 billion authorized for share repurchases. There's ample amounts of cash available to accelerate the planned repurchase program and for a more ambitious share repurchase program.

Even with reduced rates of reported revenue growth, working capital generated each quarter far exceeds the current dividend payout rate. There are resources available to management to defend the share price and step up the return of cash to shareholders through a more ambitious share repurchase program or an increase in the quarterly dividend amount.

Apple's Rates Of Growth Disguised

In reviewing the balance sheet and statement of cash flows, Apple's fundamentals remain strong and cash generated each quarter remains extraordinarily high. Gross margin will improve in subsequent quarters following the multiple product transitions in the December quarter and as the company rides down the cost curve on new product introductions. Through the March quarter, gross margin will return to FY2011 levels. Last year's unsustainable gross margin levels in the December and March quarters along with the additional week in the December quarter last year have created a scenario in which growth rates reported on the quarterly income statements will look paltry through the first half of the fiscal year.

The Apple Growth Story

In reviewing the company's financial statements what's revealed is that Apple remains a growth story. What takes time is finding the clues to solve the mystery of Apple's missing growth. The balance sheet will tell a different story than the quarterly income statements for the first half of the current fiscal year. As gross margin improves over the next few quarters and Apple aligns supply with continuing product demand, Apple's underlying rates of growth in FY2013 will become more clear.

Robert Paul Leitao

Disclosure: The author is long Apple shares